TWI Weekly Newsletter 7/13

Market Big Picture View. View my Market Analysis, Trade Ideas, and a Curated Watchlist to Prepare for the Upcoming Week Ahead!

Weekly Highlights

Market Big Picture & Long-Term Technicals

SPX closed at 6259.74. Last week we called the price action perfectly with a choppy range. We briefly made a new high but quickly sold back into the range. The market is starting to look a bit tired here. While the trend is still up, a larger pullback toward 6147 would be welcomed and considered a healthy reset. If we move through the highs, 6300 is a clear area to watch for new price discovery. The upside is becoming harder to trade in the near term without seeing more range or a bigger pullback first.

Near-Term Outlook & Trade Plan

Bearish (July 14th 6200P)

📉 Trigger: 6236

🎯 Target: 6180

🛑 Stop: 6250

Economic Calendar & Earnings

source: investing.com

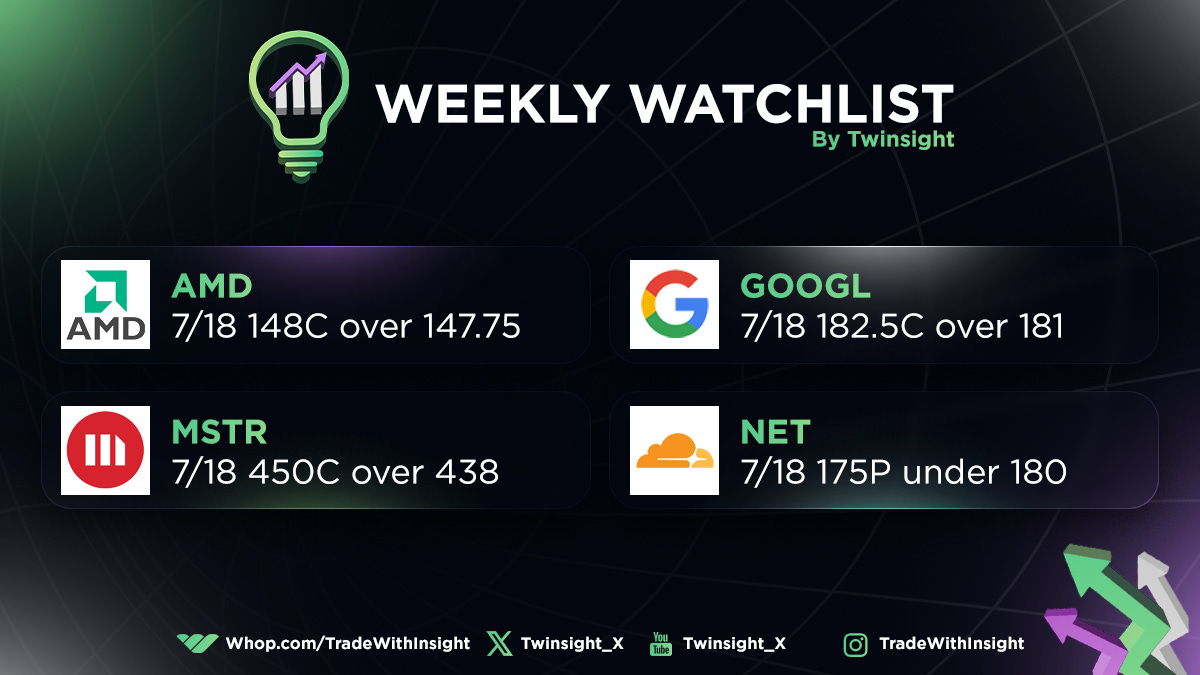

TWI Weekly Watchlist

Top Trade Ideas of the Week

$AMD Trade Idea: July 18th 148C 💡

📈 Trigger: 147.75

🎯 Target: 150.77

🛑 Stop: 144

AMD closed at 146.42. Chips saw relative strength last week. AMD has finally turned the corner and is seeing a strong recovery. This recently broke out of its daily flag and is set up to break the most recent high at 147.75 for a move to 150+.

$MSTR Trade Idea: July 18th 450C 💡

📉 Trigger: 438

🎯 Target: 457

🛑 Stop: 430

MSTR closed at 434.58. This has seen a bit of a resurgence with BTC breaking out. This gets very compelling once it is over 457 due to the limited price history above. It’s only been a year since the parabolic run and reversion. That is not a very long amount of time. Many in the past that see such corrections take years to come back, if ever. This could turn into a very in play name as long as the theme continues. This week watching for 430 to hold and the 457 level to act as a magnet that pulls price higher.

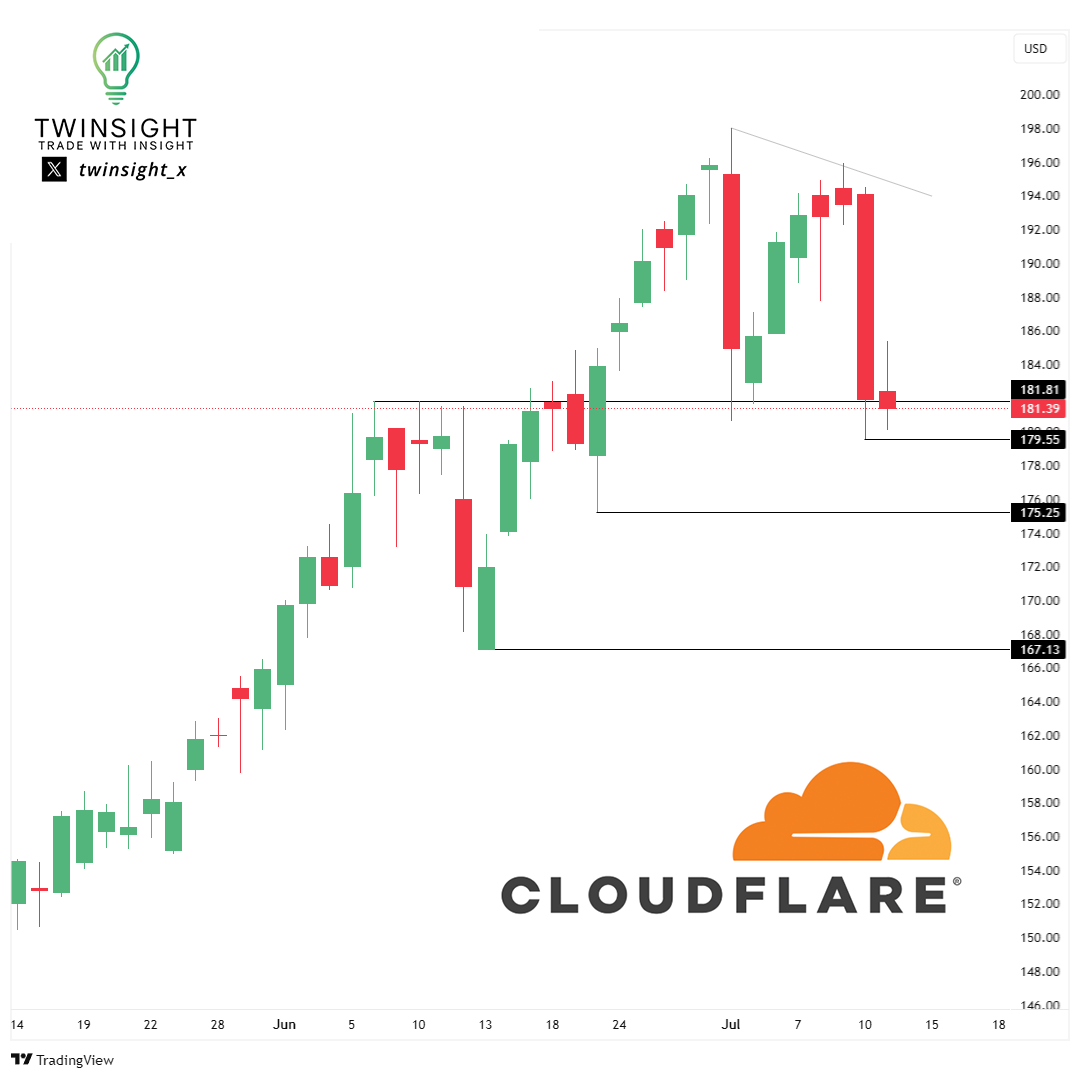

$NET Trade Idea: July 18th 175P 💡

📉 Trigger: 180

🎯 Target: 175

🛑 Stop: 183

NET closed at 181.39. Friday price action was disappointing considering other names in the space ZS CRWD PANW saw very nice continuation lower. This maybe the last to drop out of the bunch. We’re seeing some momentum names take a hit. If that continues, this is primed for a move lower. 177.37 is prior highs that could act as support near term. If that fails a move toward 167 is possible.

Join Our Professional Community!

We provide live commentary, trade alerts, education, and more every day in our discord room! Join risk free anytime here: https://whop.com/tradewithinsight

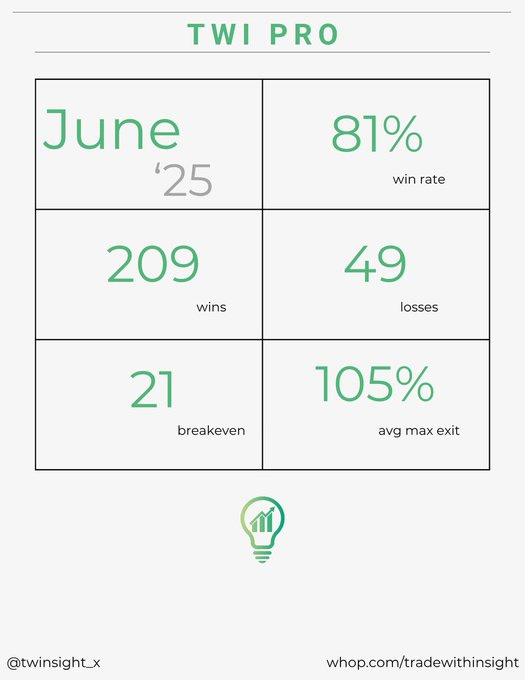

Want to review our performance first? Here was last weeks performance along with a link to the entire years worth of alert data.